Nueva Vida Monthly Newsletter: March 2013

A message from Raul Raymundo

Dear friends and supporters,

Dear friends and supporters,

I’m excited to update you on the resurrected Second Federal Savings and Loan—now operating under Self-Help Federal Credit Union. It is once again serving families as the state’s largest community development credit union. As you may remember, The Resurrection Project and Self-Help formed a unique partnership to rescue Second Federal Savings and Loan from failing. Since the majority of the Second Federal mortgages are underwater, we are starting to work with the families who are struggling with their mortgages in order to prevent further foreclosures. We need to help families keep their homes for two key reasons.

One: our communities have already been hit hard by the foreclosure crisis, and too many of our families have already lost their homes. Losing a home means more than just losing an investment. It’s the loss of stability, and the loss of a hard-fought dream. It’s the loss of certainty for children who experience the trauma of being removed from the place they called home. It’s a loss that no responsible, hard-working family should experience.

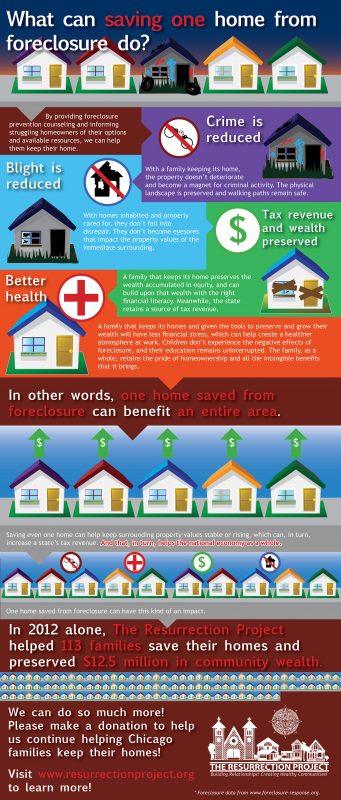

Two: a family that keeps their home doesn’t just help their street. They help their neighborhood, their city, and, ultimately, their state. The negative impact of even one foreclosed property is significant, as this infographic demonstrates. On average, a single foreclosed home represents a loss of $106,000 in loan principle, and can cost the state up to $25,400 a year in lost tax revenue and accrued maintenance and administrative costs.

When Second Federal failed and the FDIC was poised to auction off its loans, nearly 1,100 families risked going into foreclosure. If even 100 of those properties had gone into foreclosure, local government would have lost approximately $2.5 million a year, and neighborhoods would have lost approximately $10.6 million in community wealth. Had all 1,100 foreclosed, local government would have lost $27.9 million, and neighborhoods would have lost $116.6 million in community wealth. That’s $144.5 million lost all told. That does not even account for the depreciated property values that would have ensued throughout these neighborhoods, nor the millions more lost by local businesses as neighborhoods began to erode.

These were key reasons why The Resurrection Project and Self-Help moved so quickly to rescue Second Federal.

Maybe that’s the biggest difference between a standard bank takeover and the one effected by our partnership. Some takeovers are driven by profit. Some are driven by the need to strengthen one group’s position against the competition. Others happen because it’s just the way business is done.

But neighborhood revitalization is our business. The economic and social challenges facing our communities are our competition. The creation of healthy, safe, and vibrant communities for families—that’s our profit.

That is what makes this partnership between The Resurrection Project and Self-Help so unique—and so special. We are now serving thousands of people through a business model that emphasizes the prosperity not of the company, but of the family. For example, as you’ll see in this newsletter, we have just launched a loan product for DREAM students that will not only help them apply for deferred action but also help them build their credit.

And we’re just getting started.

In this issue of our newsletter:

A unique partnership resurrects a failed bank in Chicago’s southwest side

Self-Help Federal Credit Union and TRP rescued Second Federal Savings and are now serving local communities with innovative, immigrant-friendly financial products.

TRP helps a couple avoid foreclosure and keep their homeownership dreams golden

When an elderly couple fell 18 payments behind on their mortgage, they turned to TRP for help. How did we help them keep their home?

The smallest change can effect the biggest transformation: The physical redevelopment of Back of the Yards

Turning even one abandoned home into affordable housing can have a huge impact. So what has TRP done with 40 abandoned properties in Back of the Yards?

Students and parents get a sneak peek of college life at La Casa sleepover event

20 students got to sleep over at La Casa at this three-part event hosted by TRP and Escalera College Bridge Program.

TRP expands its Early Childhood Education Transition program to Cooper Elementary

TRP is taking a successful early education program and expanding it to another school!

La Casa wins at the Chicago Neighborhood Development Awards

La Casa wins first place in a very prestigious award at the 19th Annual Chicago Neighborhood Development Awards!

By the Numbers

What does it mean to save even one home from foreclosure? Click on this infographic to find out!